Operational Expertise: Your Decisive Edge in Natural Resource Investments

By GrowEasy | Dubai, UAE | June 13, 2025

Executive Summary

In today’s increasingly complex investment landscape, natural resource sectors—including oil & gas, power, chemicals, and mining—offer compelling growth opportunities. However, their success is frequently contingent upon a factor often underweighted in investor models: Operational Expertise.

This paper examines the critical role that operational insight plays across the full investment lifecycle—from initial screening through to divestment. Drawing from real-world case studies and common industry pitfalls, it demonstrates how embedding operational acumen can drive value creation, mitigate risk, and improve exit outcomes.

1. The Strategic Importance of Operational Expertise

Natural resource investments differ fundamentally from many other asset classes. They are often:

Technically intensive: involving complex engineering, supply chains, and regulatory compliance

Regionally exposed: sensitive to local labor, infrastructure, and geopolitical dynamics

ESG-pressured: requiring constant management of environmental, community, and governance obligations

Relying solely on financial due diligence or third-party reports without robust operational analysis increases the likelihood of cost overruns, underperformance, and reputational risk. Investors who develop or source sector-specific operational understanding are significantly better equipped to protect capital and unlock latent value.

2. Operational Expertise Across the Investment Lifecycle

Investment Screening

At the pre-deal stage, operational insights help determine whether a target can actually perform as projected. Key considerations include:

Asset condition and maintenance: Are facilities up-to-date or facing hidden capital needs?

Process reliability: Do existing operations run efficiently, or are systemic bottlenecks likely?

Local feasibility: Is there sufficient supporting infrastructure (e.g., power, water, transport, labor) to sustain performance?

Screening with operational rigor helps avoid pursuing targets that are superficially attractive but structurally challenged.

Due Diligence

Traditional due diligence typically focuses on financials, legal structures, and headline compliance. However, operational due diligence expands this to include:

Technical reserve verification (in oil, gas, or mining): Ensuring that resource estimates align with extraction realities

Efficiency assessments: Reviewing production rates, maintenance cycles, and process optimization

Safety and ESG audits: Identifying environmental and community risks that could impair operations or licenses

A lack of such diligence frequently leads to performance gaps that only become visible after capital has been deployed.

Portfolio Management

Once acquired, natural resource assets must be actively managed to maintain and grow value. Operationally-focused interventions might include:

Process optimization: Upgrading workflows, logistics, or energy use to reduce costs and enhance throughput

Performance tracking: Monitoring key operating metrics to identify deviations or emerging issues

Risk prevention: Establishing stronger safety and maintenance regimes to prevent disruptions

Operational oversight should continue through ownership—not end at acquisition.

Exit Planning

Operational strength is also a critical determinant of exit value. Buyers are more likely to pay a premium when:

The asset is demonstrably stable and efficient

Operational improvements made during the holding period can be quantified

Residual risks have been addressed (e.g., permitting issues, outdated technology)

Effective documentation of these elements can materially influence both valuation and buyer confidence.

3. Case Study: Oyu Tolgoi, Mongolia (Rio Tinto)

Context: Rio Tinto’s Oyu Tolgoi copper mine—among the largest undeveloped copper deposits globally—offers a high-profile example of the consequences of underestimated operational complexity.

Key Developments

The project’s underground expansion was initially budgeted at ~US $5.3 billion but experienced cost overruns estimated at US $1.2–1.9 billion.

Schedule delays reached 16–30 months due to unanticipated geological conditions and construction challenges.

Shareholders ultimately reached a US $138.75 million settlement with Rio Tinto, alleging insufficient disclosure about the true risks.

Strategic Takeaways

Technical risks such as geology and contractor execution must be scrutinized, even in large-scale projects run by experienced operators.

Internal operational concerns—even when known—must be escalated and factored into investor communication.

Governance structures need to ensure that operational insight informs decision-making at all levels.

4. Common Challenges to Operational Integration

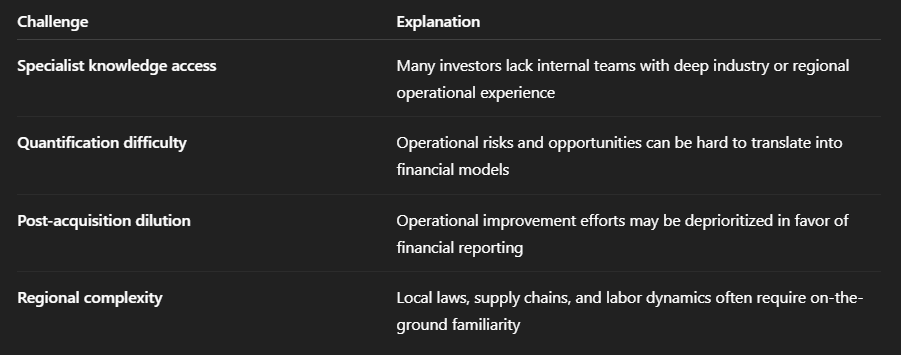

Table 1: Typical Investor Challenges

Recognizing and addressing these challenges is key to ensuring operational insights meaningfully inform investment decisions.

5. Conclusion

Natural resource investments are uniquely exposed to performance volatility, cost variability, and environmental scrutiny. Yet many of the most damaging post-acquisition issues—from unplanned downtime to cost blowouts—stem from preventable operational blind spots.

Integrating operational expertise across the lifecycle—from pre-deal screening and diligence to post-acquisition optimization and exit—significantly increases the likelihood of strong financial outcomes. For investors seeking consistent, sustainable performance in the natural resource sector, operational mastery is not a tactical advantage—it is a strategic requirement.

Explore Deeper

GrowEasy brings clarity, capability, and control to every stage of your investment journey

Connect with the Experts, Unlock Investment Success

Visit www.groweasy.ae or email us at info@groweasy.ae to understand more