Decarbonization as a Value Creation Lever in Natural Resources

GrowEasy Market Insight Report

By GrowEasy | Dubai, UAE | June 23, 2025

NEOM Green Hydrogen Facility, Saudi Arabia

Executive Summary

Decarbonization has shifted from a regulatory imperative to a fundamental driver of value creation across the natural resources sector. Investors are no longer viewing emissions reductions as a cost, but as a lever to drive superior returns, portfolio resilience, and long-term competitiveness. This report explores how global capital is flowing into decarbonization strategies—particularly in oil & gas, power, chemicals, and mining—and how institutional investors, sovereign wealth funds, and private equity players can unlock alpha by aligning with this transformation.

1. The Strategic Rationale for Decarbonization Investments

The global energy transition is accelerating. Regulatory pressures, voluntary carbon markets, and customer preferences are converging to penalize high-emission assets and reward decarbonized business models. As a result, investors are:

Embedding carbon pricing into asset valuation models.

Prioritizing investments in low-carbon technologies (e.g., CCS, hydrogen, biofuels).

Supporting green CAPEX initiatives that improve margins and ESG scores.

Key Statistic: Over 60% of global institutional investors now consider decarbonization a core investment filter (BCG, 2025).

2. Carbon as a Financial Metric

Investors are integrating carbon intensity into deal screening and portfolio management processes:

Carbon-Adjusted IRR: Projects are now evaluated with shadow carbon prices (ranging from $50–$100/tCO2e).

ESG-Linked Financing: Access to lower-cost capital is increasingly tied to emissions benchmarks.

Carbon-Optimized Portfolios: Rebalancing strategies are targeting sectors with rapid abatement potential (e.g., blue hydrogen, gas with CCS).

3. High-Impact Decarbonization Plays in Natural Resources

Blue Hydrogen + CCS Integration

Growing focus on export-oriented hydrogen production (e.g., GCC ammonia hubs).

Enhanced revenue from offtake agreements and voluntary carbon credits.

Industrial Clusters & CCS Hubs

Development of shared CO2 transport and storage infrastructure (e.g., Jubail, Abu Dhabi).

Lower unit costs via economies of scale and public-private co-investment.

Electrification of Industrial Loads

Transition from diesel to electric equipment in mining and logistics.

Partnerships with renewables developers to green power inputs.

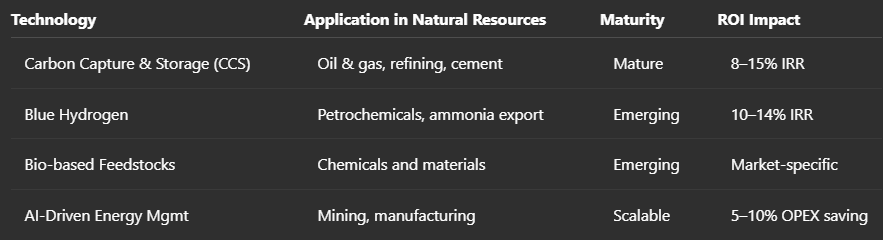

4. Decarbonization Technologies Driving Returns

5. Regional Investment Hotspots

Middle East:

Hydrogen-ready ports and CCS infrastructure.

Policy incentives (e.g., UAE Net Zero 2050, Saudi Green Initiative).

Africa:

Opportunities in flare gas capture and methane abatement.

Green ammonia pilots in Egypt and Mauritania.

Former Soviet Union (FSU):

Industrial electrification in Kazakhstan.

Potential for CCUS in oilfields across Uzbekistan and Azerbaijan.

6. How Investors Can Take Action

Integrate Climate into Due Diligence

Assess Scope 1–3 emissions and abatement roadmap.

Model regulatory and reputational risk under future carbon scenarios.

Seek Out Transition-Ready Assets

Target companies with credible decarbonization plans and access to green finance.

Use ESG as a Value Creation Lever

Tie management incentives to carbon performance.

Monetize emissions reductions through carbon trading platforms.

7. Case Snapshot: GCC Blue Hydrogen Play

A consortium-backed blue hydrogen plant in the UAE secured:

$1.2B in green finance

20-year ammonia offtake contract

14.8% project IRR after carbon credit monetization

Insight: Strategic alignment between infrastructure, policy, and carbon markets drives premium valuations.

Final Thoughts

Decarbonization is not simply an ESG play—it is a strategic imperative for long-term value creation. As regulatory, customer, and capital market forces converge, investors must lead, not follow. The winners will be those who can blend technical due diligence with forward-looking climate strategy, unlocking opportunities others overlook.