Powering the Future, Securing Transformative Returns

Insights for Battery Materials Investment

By GrowEasy | Dubai, UAE | June 10, 2025

Executive Summary

The surging demand for battery materials presents one of the most dynamic natural resource investment themes of the decade. As global electrification accelerates—driven by electric vehicles (EVs), energy storage, and green industrialization—battery-critical minerals such as lithium, nickel, cobalt, and graphite have transitioned from niche commodities to strategic assets.

This paper provides an evidence-based overview of the battery materials investment landscape across the Middle East, Africa, and the Former Soviet Union (FSU), examining resource availability, infrastructure development, regulatory considerations, and ESG risks. It outlines key regional opportunities, highlights the main operational and strategic challenges, and identifies success factors for investors looking to participate in this transformative sector.

Market Outlook

A Decade of Structural Growth

The battery materials market is expected to grow significantly, from an estimated USD 57–63 billion in 2024 to over USD 100–180 billion by 2030–2034. Compound annual growth rates (CAGR) vary by material and use case:

Lithium: 12–23% CAGR, driven by high-density EV batteries

Nickel: 5.75–10% CAGR, depending on battery chemistries

Cobalt: Demand moderating, but remains essential in LCO/NMC chemistries

Graphite: Expanding rapidly in both natural and synthetic forms for anode supply

The global drive for decarbonization is fuelling this growth, as government incentives, OEM electrification targets, and renewable integration converge.

Regional Investment Landscapes

Middle East

Resource Potential: Early-stage developments in brine-based lithium (e.g., Saudi Arabia) and emerging graphite interest in the UAE.

Policy Momentum: National visions (e.g., Saudi Vision 2030) are allocating billions in mining and industrial diversification, including battery materials.

Infrastructure Edge: Access to low-cost energy and industrial zones could support competitive refining and processing.

Investment Consideration: Local processing remains underdeveloped; strategic partnerships and downstream integration are key to unlocking full-cycle returns.

Africa

Resource Abundance:

Cobalt: 70% of global reserves concentrated in the Democratic Republic of Congo (DRC)

Lithium: Zimbabwe, Namibia, Mali, and Ghana

Graphite: Mozambique and Tanzania are emerging exporters

Strategic Backing: Increasing engagement through EU Critical Raw Materials Acts and US-led initiatives like the Minerals Security Partnership.

Risk Factors: ESG compliance, artisanal mining exposure, and infrastructure gaps require rigorous project vetting.

Success Drivers: Mechanized operations, traceability systems, and community engagement frameworks are critical for long-term asset viability and LP acceptance.

Former Soviet Union (FSU)

Mineral Wealth: Significant nickel, lithium, and rare earth potential in Russia, Kazakhstan, and Uzbekistan.

Policy Environment: Kazakhstan and Uzbekistan are opening mining to foreign capital, offering tax incentives and export access.

Geopolitical Dynamics: Sanctions, export controls, and regional instability remain constraints—particularly in Russia.

Operational Challenges: Complex geology and fragmented regulatory environments call for experienced local partnerships and careful sequencing of capex deployment.

Investor Strategies: Growth, Risk Mitigation, and Operational Excellence

Project Screening and Due Diligence

Battery material projects are highly sensitive to:

Reserve accuracy (particularly in hard rock vs. brine extraction)

Processing scalability

Permitting and community risk

Geopolitical stability

Independent geological, environmental, and legal reviews are essential to validate feasibility and forecastability before capital allocation.

ESG Alignment as a Strategic Imperative

With rising scrutiny from LPs, regulators, and end-users:

Carbon intensity, water use, and labor practices are under close review.

Access to green finance and premium buyers increasingly depends on documented ESG performance.

Implementing robust ESG frameworks, including traceability systems and local benefit-sharing, is both risk mitigation and a growth enabler.

Operational Efficiency for Cost Competitiveness

Margins in battery materials are increasingly driven by:

Energy consumption per tonne produced

Yield per input unit

Downtime minimization

Operational excellence strategies include:

Automation and digital monitoring in extraction and processing

Water-efficient beneficiation

Co-location with renewable energy sources

These directly impact cost curves and sustainability metrics.

Exit Planning and Market Timing

Given cyclical price dynamics and rapidly evolving technology:

Exit value can be heavily influenced by macro factors such as EV adoption rates, tech substitution (e.g., LFP vs. NMC chemistries), or government subsidy shifts.

Public market receptiveness to battery materials IPOs or SPACs may fluctuate.

Investors should maintain flexible exit strategies and continuously reassess timing based on evolving sector and regional developments.

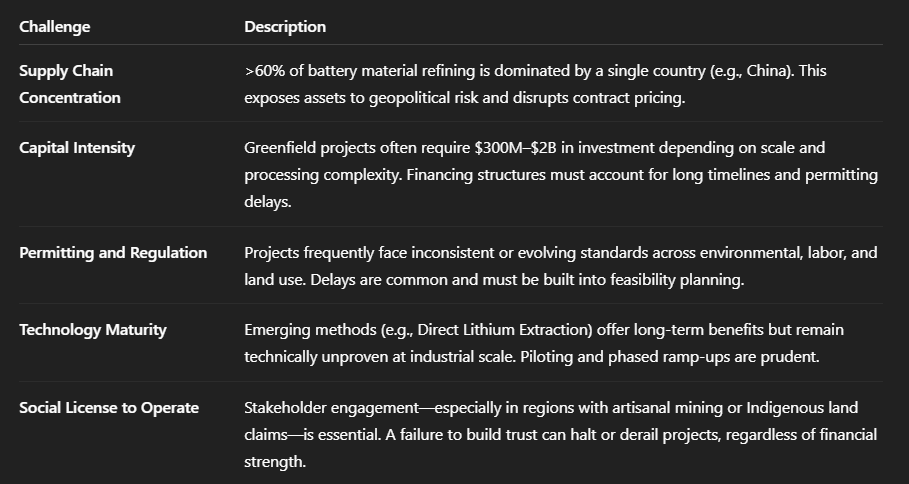

Structural Sector Challenges

Conclusion

Battery materials are foundational to the global energy transition and present a rare confluence of resource scarcity, policy support, and demand certainty. For institutional investors, the sector offers a high-impact opportunity—if approached with operational discipline, ESG alignment, and regional nuance.

Success requires:

Rigorous front-end due diligence

Strong governance across development and operations

A balanced portfolio of upstream (extraction) and midstream (processing) investments

Flexible, data-informed exit strategies

Investors with a long-term view and a willingness to engage with on-the-ground complexity are well-positioned to deliver strong, resilient returns in this transformative space.

Explore Deeper

GrowEasy brings clarity, capability, and control to every stage of your investment journey

Connect with the Experts, Unlock Investment Success

Visit www.groweasy.ae or email us at info@groweasy.ae to understand more